Investment belts are tightening. Female Founders are feeling the bite. (But that’s nothing new!) Women are equipped to take the recession head on and here’s why…

In May, venture capital firm Sequoia published a report entitled ”Adapting to Endure” that demonstrates the hard truth about recession. The Good news is that female founders are likely to come up on top.

While underlining that investment will be cut, the report also provided suggestions on how those seeking capital can navigate their way through this crisis. To paint the picture of what’s happening in the world of investment and what it means for female entrepreneurs, we felt it key to address the main suggestions made in the 52-pages long report as well as the corresponding press coverage.

Every pound is more precious than it was, so how are you managing your priorities right now?

The Adapting to Endure report is a warning for those who ignore the changing environment and a great guideline for whoever is ready to roll up their sleeves and transform their business accordingly.

The macro environment Sequoia describes, paints a tricky picture. In the last 6 months, the cost of a new mortgage for the same house has gone up by 67% – the largest percentage shock in 50 years.

It goes on to outline that taking business competition as the reference point is useless too, as no one actually knows what they are doing. Further more if you have become more hesitant in your decision making, it’s underlines how it’s not just you – which comes with some reassurance.

Priority reassessment and belt tightening both seem like the agenda for the majority – but Sequoia underlines that there are different strategies we could, as brand owners, embody in order to navigate our way through this uncertainty.

One of the highlights of the report is that growth at all costs is no longer being rewarded. What investors need right now is near-term certainty around profitability due to inflation, interest rates and war.

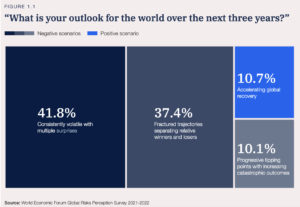

42% of people say that their outlook for the world over the next three years is “consistently volatile with multiple surprises,” according to the World Economic Forum’s Global Risks Report. In these circumstances, Sequoia states, it is no surprise that the market is signaling a strong preference for companies who can generate cash, today.

So how will you and your brand emerge as role models, not villains, from this once in a generation crisis?

As the previous Chairman and CEO of General Electric Jack Welch summarizes, “If the world outside your company is changing faster than the world inside your company, the end is near.”

It is surely survival of the fittest – but beyond that, the report indicates it is survival of the quickest.

To avoid the death spiral and actually win, now is the right time for brands and entrepreneurs to show resilience with strategies that go beyond cost cutting.

So, what strategic guidelines does the report offer to prepare for never ending uncertainty?

-

Every crash starts with founders not confronting reality, so the first step is to be courageous in facing the truth and make hard choices with enduring ambition. Although success is not guaranteed, keep in mind that being indecisive is usually a higher risk than a potential learning opportunity. Do not fall into the lazy trap of wishful thinking.

-

Secondly, being attentive and mindful to every stakeholder’s needs and wants. That means remembering your team is made up of consumers and human beings. To make sure ownership of the work remains at great levels, remind stakeholders of the reason why your brand exists through reaffirming your mission and values. Showcase your leadership by being both motivational & pushing and inspirational & pulling. In your tone of voice, beware of sounding like a kill-joy and balance optimism with realism, always tapping into your authenticity.

-

Thirdly, to prepare your brand beyond cutting costs, the report recommends focusing on what you can control, avoiding trading in the future, and being resourceful. What is worth exploring is financial degrees of freedom – i.e. exploring new ways to earn more from the existing customers. It is important to keep in mind that you cannot cut your way to a business. Sequoia suggests considering constraints as opportunities to concentrate more on creative solutions rather than throwing money down the drain in hopes to solve the problem.

The most reassuring news is that, according to a Financial Times article, female founders who always had to fight harder for capital are already prepared for the recession. It seems like while female-founded businesses are thriving, they are also bumping up all markets. Last year was an abundant one for the UK with $12.8bn total deal value in 2020 soaring to $32.9bn in 2021. It was also a record-breaking one for female-founded businesses – 140,000 companies were launched in that category in 2021.

Regardless of the resilience female entrepreneurs have to offer to drive more resourceful and sustainable businesses, what they receive in venture capital funding remains extremely disproportionate. According to this year’s Rose Review into Female Entrepreneurship, only %1 to be exact.

Due to discrimination, bias and adversity women entrepreneurs have had to face in order to survive in business, they have learnt to build greater resilience. So, it is not surprising that they are more comfortable when it comes to confronting the harsh reality and confidently making difficult decisions during this recession.

Balancing the extreme gender-based disproportion in funding would not only serve for the businesses of female entrepreneurs, but the whole economy in general.

If women started and scaled their ventures at the same rate as men, £250bn worth of business would be unlocked for the UK. However Natwest’s Rose review reports only 1% of funding is reaching female founder businesses yet Female Founded businesses perform 63% better than with all men founding teams.

So, the potential of female founders is a real goldmine, but we are turning the other way and choosing to throw money at the problem, instead of tapping into it.

“To prepare for this recession, every brand owner will need to channel the strong and feminine power of resilience. What the already-resilient female-founders specifically need is building brand reputation now, so that they can turn their enhanced capabilities into advantage later. This means, crafting a clear brand strategy focusing on their unique assets that will help them get through this recession. This is the right time to invest in building a brand perception that highlights distinct value. Consistency in delivering the right messages and experiences to communicate this builds credibility, reputation and trust – making the brand the preferred choice. It’s quite simple really and in my mind glaringly obvious. Without building brand equity you can’t hold the competitive advantage needed to protect pricing which in turn protects profit. Look at how your brand can deliver true value to your end user. Deliver even harder on your promise to strengthen distinct brand experience. Be brand brave, don’t dumb down, except you won’t have it all figured out, embrace the bumps in the road and see the opportunity in mistakes, and while others are still adapting, you’ll be winning.” Ozlem Tuskan, CEO, The Resilient

Although many female-founded brands are in business for the right reasons and often initiatives that hold great potential for growth, they need to reclaim their power to really leverage the gold mine of a potential they are sitting on.

Apart from having the courage to confront harsh realities of recession, female entrepreneurs should also be brave in owning their assets with clarity and rigor. After all, when the dust settles, what we discover might be an unusually high percentage of female entrepreneurial success.

Authors

Ozlem Tuskan, CEO, The Resilient

Ozge Sargin, Senior Strategist, The Resilient